Over the last 5-10 years the presence of private equity in the industrial gas industry has dramatically increased. Not just at the mid-market level (with local and independent producers/distributors), but now they have made their presence known on the regional and global stage with companies like PAG Capital in China and CVC Capital globally with the Messer Group. Taking a closer look at this trend and its drivers, along with a forecast for the short/medium term will be topic of this article.

Background/History

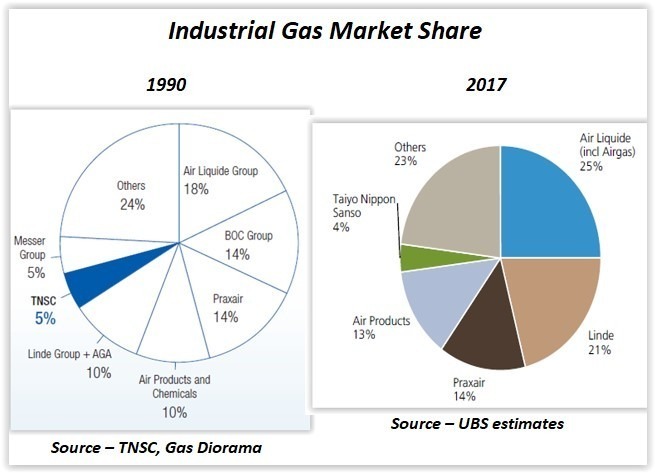

Industrial gases have been around a long time, with many of the gases discovered and refined during the Industrial revolution. However, the industry was “truly birthed” in the early 1900s with the invention of “air separation” utilizing cryogenic distillation to separate air into its constituents. Some of the industry’s early entrants were prior to World War I (Linde, Air Liquide) and later entrants just before World War II (Air Products, Messer) are still around. A few others joined the industry later and grew to global prominence such as Praxair prior to its merger with Linde in 2018 and Taiyo Nippon Sanso. So, the list of global players is pretty short which has resulted in some saying this industry is a bit “insular” (highly consolidated) with the top-5 companies commanding greater than 75% global market share since the 1990s.

So What Changed?

Private Equity (PE) has also been around a long time as well. It formally started after World War II when the first “true” PE firms were established (ARDC and JH Whitney). However, the industry didn’t start to grow and pursue large transactions until 1980s (i.e., RJR Nabisco, Safeway, Federated Dep’t stores, Uniroyal Goodrich, etc.) and onwards, going through multiple “boom and bust” cycles. It seemed that the Chemical industry wasn’t getting much attention at this time and it wasn’t until the late 1990s and early 2000s before we observed some activity. Bain Capital’s acquisition of German company Brenntag in 2004 was one of the early ones, and after a series of M&A transactions across Europe and North America, the company emerged as the world’s largest chemical distributor. Other examples proceeded in select commodity and specialty chemical segments to the point where the industry has been executing 30-70 PE transactions annually since 2009 per Deloitte.

Although, industrial gases is a segment of the chemicals industry it still was not getting the same level of attention from PE buyers as other areas of the chemical industry for a variety of reasons:

- High Industry consolidation – top 5 players have 75%+ market share, with industry viewed as an oligopoly…

- Capital intensity – one of the most capital intensive segments of the chemical industry.

- Significant competition – all the major players are present in all the significant global markets, relegating other players to smaller or emerging markets.

In addition, the most of the top-5 industry players were embarking on a buy-up of independents and distributors to build scale and market share in select geographies. One industry player (Airgas) employed a “PE-like” model and acquired 125+ businesses over a 9 year timeframe (2006-2015), ultimately growing into a top-10 global player (predominantly based in the US), prior to its acquisition by Air Liquide.

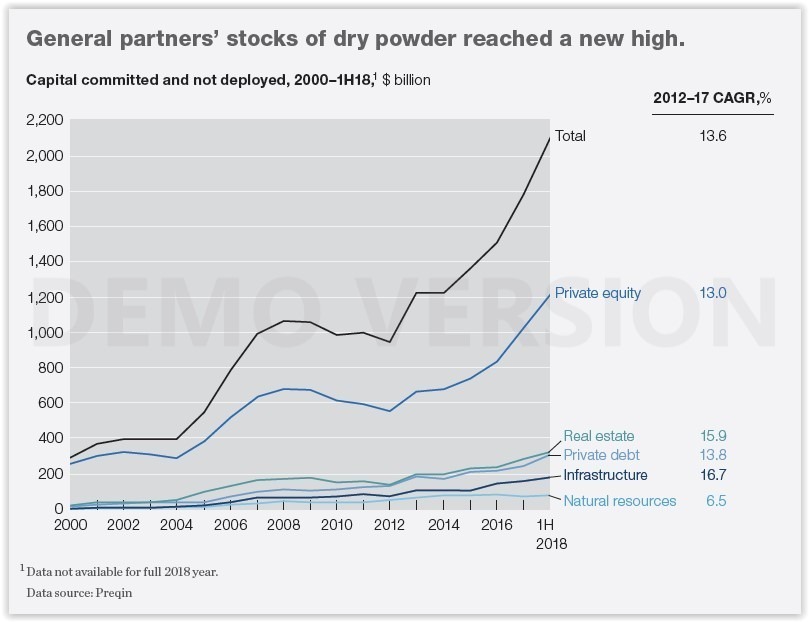

As a result, PE was initially relegated to (and focused on) suppliers of major products/services to the industry such as cylinders (Kanto 2007), storage equipment (Taylor-Wharton 2007), equipment/services (BOC Edwards 2007), and components/services (Acme Cryogenics 2006). As the PE market continued to grow with increasing amounts of “dry powder” available, and the economics of the industrial gas industry continuing to improve, eventually the transactions moved to acquiring positions and ownership to create industrial gas platforms (i.e., CI Capital 2011). Larger players started to participate in the industry with Aurora Capital acquiring NuCO2 in 2008, Warburg (BaoSteel Gases in China) and Goldman Sachs (Daesung Gases in South Korea). So, PE had finally arrived.

Private Equity Today

As we fast forward to today, and look at recent PE acquisitions or investments, it has clearly arrived and has participated in some of the largest deals. Some of the noteworthy transactions include:

- PAG Capital – acquired China’s largest independent industrial gas company (Yingde Gases) and BaoSteel Gases creating #3 player in China.

- MBK Partners – acquired #2 player Daesung Gases in South Korea from Goldman Sachs.

- CVC Capital – partnered w/ Messer Group to acquire Linde’s Americas businesses (US/Canada/South America).

- IMM – acquired Linde’s business in South Korea

- CI Capital – sells Tech Air after 24 bolt-on acquisitions to Air Liquide’s Airgas subsidiary

- Adira Capital – acquired Linde’s Pakistan business

PE is now participating at the highest levels of the industry owning significant positions in Asia and the Americas, with Europe still an opportunity for growth.

The increasing interest in the Industrial gas industry is partly due to the maturing of the PE industry, but also the accomplished ownership teams, strong safety record, diverse customer base, predictable revenue and healthy cash flow margin and ROC that the industry offers. Those characteristics along with relatively strong growth over the last 2-4 years have contributed to the recent uptick in transactions.

Future Outlook

Going forward, the question is what is next? It is very clear that PE’s presence will continue to grow and then stabilize as it has done in adjacent chemical market segments. Some of the expected focus areas will be:

- China – gas market (structurally) is where the US market was 15+ years ago….opportunity for consolidation. Over 1000 small manufacturers are candidates to be part of a roll-up strategy (that has started) and clearly domestic companies (i.e., PAG Capital, Hangzhou Hangyang) have the advantage over international players.

- India – per the Competition Commission of India (CCI), Linde was required to make 3 divestitures (Eastern region business, southern region business and their position in the Bellary Oxygen JV). One transaction was completed last month with Air Water Inc. (Japan) purchasing the eastern region business. Two more opportunities remain (if not closed already).

- Family-owned companies in select emerging markets – emerging markets around the world that have high single digit or double digit growth rates (select countries in Asia, Eastern Europe and South America) have industrial gas companies that have started as family-owned businesses that need to capital to scale.

Remember, the top-5 players of Linde PLC (UK), Air Liquide (France), Air Products (US), Taiyo Nippon Sanso (Japan), and Messer (Germany), will remain aggressive to secure and expand their market share beyond organic growth. So, PE is no longer operating “under the radar” and are pursuing some of the same deals the majors are pursuing. So, I would suspect that PE content will continue to grow over the next 2-3 years, but growth to slow and stabilize in the medium term (3-5 years). We’ll see how it goes…

Keywords: #chemicalindustry, #industrialgas, #business, #airproducts, #airliquide, #lindeplc, #messergroup, #privateequity, #PAGCapital, #CVCCapital, #Goldmansachs, #Warburgpincus, #Deloitte

————-

Art Anderson is Managing Principal for AH Anderson Consulting, LLC, which focuses on helping companies be more productive, efficient and competitive. Art has more than 30 years of Industrial Gas business and consulting experience. With most of his experience at Tier One player Air Products, he has held leadership roles in sales, marketing, product management & regional P&L management for the full portfolio of offerings (packaged gases, merchant, tonnage/pipeline and related equipment/services). Art has also held functional leadership roles in Customer Engagement, Global Business services and co-led one of its global businesses through its SAP journey, giving him complete understanding of how an industrial gas company operates. He currently provides strategic advisory and hands-on support to companies in the Industrial gas and Specialty chemicals industries looking to improve their competitive position, lower operating costs, improve productivity and optimize customer experience. Learn more at www.ahandersonconsulting.com. Art can be reached directly at art@ahandersonconsulting.com.