The industrial gas industry provides products that are not typically known by the average consumer but, are critical to the manufacturing process of products they use everyday (i.e., computers, cell phones, packaged foods, gasoline, etc.). There was a famous tagline used by BASF twenty (20+) years ago that said,

we don’t make a lot of the products you buy…we make a lot of the products you buy better.

BASF

This tagline still fits the industrial gas industry quite well. However, over the last 1-2 years, there has been plenty of dialogue on the pursuit of opportunities in the “Coal Gasification” space by industrial gas companies. This seems a bit out of place for this “low-profile” industry, but due to some favorable end-market conditions in select geographies, these projects have received interest from the industry leaders. The market drivers, future outlook for coal gasification, and implications for the broader industrial gas industry are the subjects of this article.

Background

For those not familiar with the term gasification, it is a chemical process that converts any carbon-based material (i.e., coal, wood, biomass, natural gas, etc.) into energy without burning it, as shown by the chemical reaction below:

3C (i.e., Coal) + O2 + H2O (Yields) H2 + 3CO

Therefore, “coal” gasification chemically transforms coal into energy, and that energy is called “syngas.” It is an abbreviated term for synthesis gas, which is a gaseous mixture of hydrogen (H2), carbon monoxide (CO), and other trace components. This syngas can then be “cleaned up” and then transformed into more value-added products like ammonia, methanol, synthetic petroleum products (i.e., natural gas), and other chemicals. Industrial gas companies have historically provided just the oxygen for these coal gasification projects (in large quantities), but over the last several years have begun to take on larger scopes of responsibility.

The Market

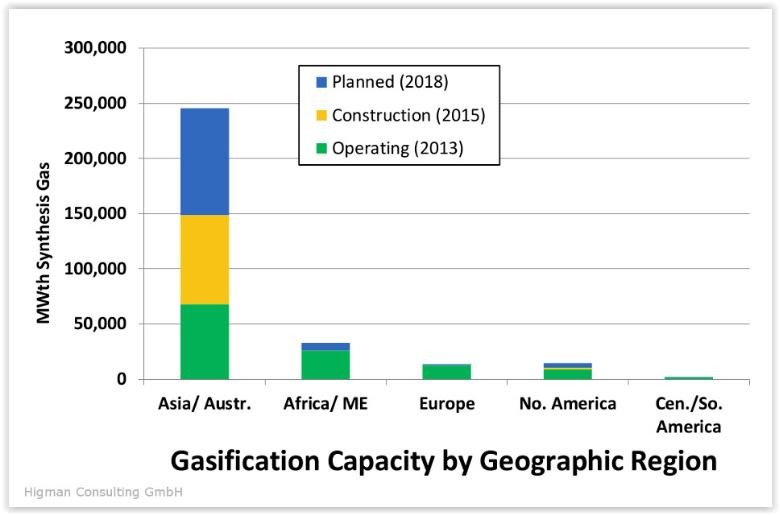

Coal gasification has been around for a long time dating back to the Industrial Revolution (obviously in a cruder form), but over the last 30+ years it has grown dramatically with large-scale coal gasification installations primarily for electricity generation, or for production of chemical feedstocks. Per the Global Syngas Technology Council (GSTC), there are approximately 400 gasification plants Worldwide (WW) in operation containing nearly 1000 gasifiers. Most of the WW capacity is in Asia today, and future growth is expected to primarily occur in Asia as well, with China, India, South Korea, and Mongolia being the leading geographies. The key reasons driving coal gasification capacity in Asia include:

- Energy security — fuel imports (i.e., liquefied natural gas (LNG)) are extremely expensive throughout Asia. Coal gasification offers a way to use in-country coal reserves to generate “synthetic” natural gas to reduce imported LNG.

- Local Coal Reserves — some 60 percent of the world’s fossil energy reserves are in coal, located in areas where the energy demand is greatest (i.e., China).

- Reduce Gasoline dependence — China has become the largest automobile market in the world sharply increasing gasoline demand. Coal gasification offers the ability to convert syngas to alternate fuels (i.e., methanol) that can be blended with gasoline to reduce consumption and imports.

There are several other end-market driven examples of where syngas can be converted to value-added chemicals (i.e., ammonia, petroleum products, etc.) which reduce either import costs or improve reliability of supply.

Industrial Gas Fit

Over the last few years, there have been a few well-documented coal gasification projects that have faced technical and political challenges especially in the US (i.e., Southern and Duke Energy). So, you may ask why would the industrial gas industry have interest in this space with all the negative publicity? Well, clearly there are some increased risks when the end product of coal gasification is primarily power versus “value-added” chemicals (as demonstrated by the two previous examples). However, the financial upside can be significant if there’s a strong business case for the end products (i.e., value-added chemicals). Some specific benefits for pursuing this market are:

- Accelerated Growth – this market segment offers growth rates of 2-3x core industrial gas business growth of 3% per year.

- Extend Portfolio – except for coal supply and related equipment, the supply of gasifiers and syngas clean-up systems leverage many of the core competencies that the industry leaders already own.

- Proven Business Model – adding coal gasification scope to their existing finance, build, own and operate model, under a long term secure contracts, aligns well with their strategy.

As with any opportunity, there are some risks that need to be mitigated as well including:

- Environmental – China has made commitments to the Paris Climate accord (i.e., CO2 emissions) that need to be met, and coal gasification is a big contributor.

- Political – North America & Western Europe have strong environmental lobbies which can influence the “direction and cost” of opportunities. In some Asia countries like China, it is less consumer-driven but more central/provincial government driven which can affect projects as well.

- Technological / Economic – coal feedstock variability/availability, project and operational risk, and technology to reduce CO2 emissions, are all risks that companies need to mitigate and account for with these large projects.

Some of the players have clearly made their decision, despite the risks, to pursue these opportunities, while others appear to be on the side lines.

Future Outlook

Due to the size and complexity of these projects only Linde PLC, Air Liquide and Air Products are capable of executing these projects, and frankly it appears that only one is “publicly” acknowledging their pursuit of these opportunities, Air Products (AP). They have acquired the gasification business of the two top players (Shell and GE), and have been successful in securing projects in China and the Middle East valued at >$14 Billion in total project capital (not AP’s share). Air Liquide in many ways was the first to pursue this space with their acquisition of Lurgi (the #2 or #3 gasification player) over a decade ago, and was the first to deliver the first complete gasification scope of gasifiers, air separation units (ASUs) and syngas clean-up systems for Fujian Shenyuan New Materials in China back in 2016. They appear to have a very competitive offering, yet they have not publicly communicated pursuit or awards of any recent coal gasification opportunities. Linde PLC through its Linde Engineering division has plenty of experience with gasification but appear to limit their scope of supply to ASUs and the syngas clean-up systems, excluding the gasifier scope. They also have not publicly shared pursuit or awards of any recent Coal gasification opportunities, but they clearly have the largest backlog in the industry of nearly $9 Billion (inclusive of their Engineering Division). Approximately 50% of their projects are in Asia, and approximately 50% are in either the chemicals or energy space. If any of those clients develop gasification opportunities, they will be in a good position to leverage those opportunities.

So, it appears that Air Products may be the most aggressive in the short/medium term in pursuing opportunities in the coal gasification market. But, with over 50 opportunities being pursued (as stated on a recent earnings release), it will be exciting to see how this space plays out in the market place…so stay tuned…

Keywords: #chemicalindustry, #china, #industrialgas, #business, #airproducts, #airliquide, #lindeplc, #coal, #gasification, #syngas

——–

Art Anderson is Managing Principal for AH Anderson Consulting, LLC, which focuses on helping companies be more productive, efficient and competitive. Art has more than 30 years of Industrial Gas business and consulting experience. With most of his experience at Tier One player Air Products, he has held leadership roles in sales, marketing, product management & regional P&L management for the full portfolio of offerings (packaged gases, merchant, tonnage/pipeline and related equipment/services). Art has also held functional leadership roles in Customer Engagement, Global Business services and co-led one of its global businesses through its SAP journey, giving him complete understanding of how an industrial gas company operates. He currently provides strategic advisory and hands-on support to companies in the Industrial gas and Specialty chemicals industries looking to improve their competitive position, lower operating costs, improve productivity and optimize customer experience. Learn more at www.ahandersonconsulting.com. Art can be reached directly at art@ahandersonconsulting.com.